Futures contracts are contracts that settle on a date in the future for the seller to deliver a certain volume of a product. The seller of the contract determines the price that will be paid for the product at the time it is delivered, and for how much more or less than that. Futures contracts were traditionally traded on the futures exchanges located in New York and Chicago but with the growth of electronic trading and the availability of Nasdaq web sites, many futures contracts can now be traded online.

Advantages

The advantages of trading futures contracts over traditional commodities trading are that there is less margin requirements, less paperwork and reporting, and no commissions or taxes. The contracts themselves are standardized so that when trading them you know what you are getting. There are also no delivery requirements and, due to the un-derivative nature of the futures markets, commodity futures contracts are not affected by factors such as price stability, which can cause price volatility. Traders who use futures contracts as their instruments of trade can avoid such risks as market manipulation, price jumps, and market ’tilts’. In short, futures contracts give the traders more leverage in trading.

How do you purchase a futures contract?

In order to purchase a futures contract, investors must pay a fee known as the margin. This helps to ensure that the investor can afford to risk a certain amount of the total amount of the future contract until the date the contract is settled. If the future contract reaches its maturity date, then the margin will be due, and the investor will have to sell his shares of the future contracts. The primary reason for the fees is to ensure that the investor does not outlay too much of the future contract’s proceeds on margin purchases.

In order to participate in the futures markets, investors must have a brokerage account. This is one of the most important reasons why futures contracts are so popular. Through a broker, a trader can access the futures markets and participate in trading. The ease of trading futures allows individuals with a wide range of investment options and backgrounds to make money from their financial portfolios.

Spot & Forward Contracts

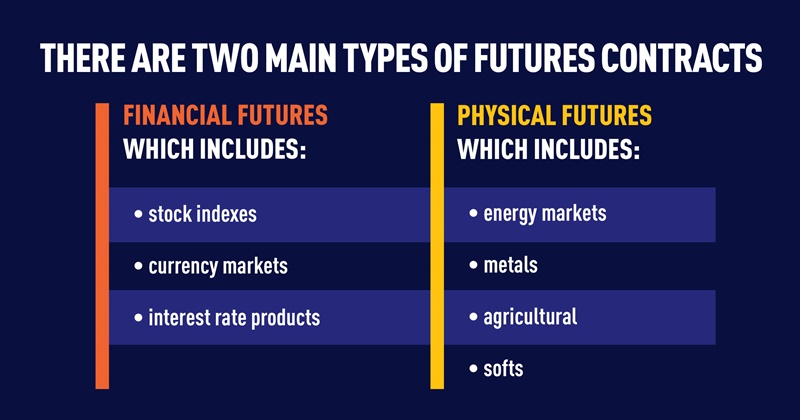

There are two primary types of trading futures: spot or forward contracts and future contracts. Spot futures refer to those where a contract is purchased today and the buyer strikes it against another party sometime within the next few days. This kind of future contract is usually traded in large quantities because the payoff is immediate. On the other hand, forward futures allow for future payments to be settled out of the cash proceeds of the transaction.

Futures contracts are also used as collateral for loan applications. In fact, the futures market is the largest cash/equity market in the world. Because futures are generally not considered as a high risk investment vehicle, they are offered by many brokers to their customers. By purchasing future contracts, investors can benefit from low risks while experiencing higher yield investment opportunities.

Leave a Reply