2020 introduced crypto staking and opened new opportunities for the cryptocurrency world. It was unlike 2018, when many people aggressively took profits during the bear market. There was no place to put their cryptocurrency, which was decreasing in value at the time. But, with the introduction of Decentralized Finance (DeFi), we could see more reasons for investors to HODL even after this cycle.

What Is Crypto Staking?

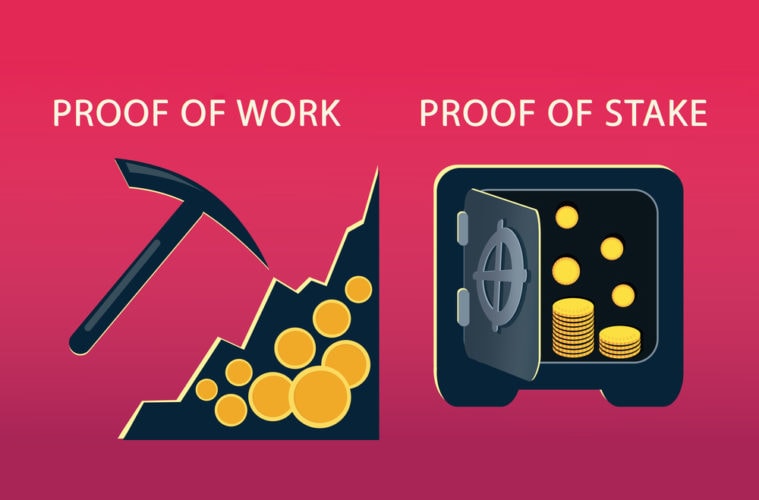

Staking allows a cryptocurrency holder to lock his coins in a system to participate and help maintain its operations. It works for blockchains that have integrated a proof of stake (PoS) system. Through staking, you help a system maintain its liquidity and also get rewards as a result. Many people compare it to mining, but it’s less harmful to the environment and has better scalability.

Staking allows various blockchain platforms to maintain high transaction speeds. The more people stake, the better the platform’s scalability. Many of today’s most popular blockchains and exchanges use staking as a means to help promote a more fluid system. Often, you get a percentage of your staked coin back after a set locked period.

Staking becomes a form of passive investment where your coins begin working for you. Instead of just sitting at a wallet or an exchange, they work to increase the value of your portfolio.

What Can I Stake?

Almost all altcoins have staking options, depending on what the platform needs for its operations. One of the most popular options for staking is Ethereum. You stake Ethereum to support the ecosystem and get a reward until the Ethereum 2.0 launch later in 2021. It is a longer process than most staking projects, and it also requires a minimum of 32 Eth, which many don’t have.

You can also stake in other blockchains to help their development. Blockchains like Icon, Algorand, and Tezos each have their own staking programs and rewards system. You need to stake their native coin for a fixed period to get the rewards. Staking is also available on Decentralized Exchanges (DEXes) like Pancakeswap (CAKE). You can stake Cake to earn Cake as a reward.

In staking, you often get a percentage return of the crypto you stake. There is another option called yield farming, wherein you stake specific crypto to get the rewards of another crypto. It’s a way to help provide liquidity for lower market cap altcoins and support the overall ecosystem. It’s a popular option among exchanges and DeFi platforms.

How Do I Stake?

There are two main ways to stake coins. The first is through an exchange. Two of the largest exchanges, Binance and Coinbase, both offer staking programs within their system.

In Binance, you’ll need to visit the Earn area of their website or app. You then choose the coin you want to stake from a list and see the APY (average percentage yield) for each. After you decide on a coin, you set the amount you want to stake and set the period to lock it in. After a day, the staked crypto begins accumulating rewards until its lock period is over.

Staking periods in Binance range from 7 to 90 days. Ethereum staking is the longest, which you’ll need to stake for up to 24 months.

The other option is through a hardware wallet or cold wallet. If you’re keeping your cryptocurrency on a cold wallet like Ledger, you’ll need to install the coin’s app first. You’ll then migrate the crypto that you want to stake through Ledger live. A similar process follows for other hardware wallet brands.

Crypto Staking Is Here To Stay

Crypto staking provides an alternative to mining for all investors. It’s better for the environment and also rewards its users. It’s a way of passive income that was unavailable in the crypto space during past bull market cycles. In 2021, staking continues to be popular and will likely flourish as DeFi develops.

Leave a Reply